I read Principles for Dealing with the Changing World Order by Ray Dalio on Apr 13th, 2023

The author, Ray Dalio inspected the historical facts to identify the patterns for nations rises and falls, aka Big Cycle.

Big Cycle

Rising

The leadership is capable and design an excellent system to boost the productivity with the investment on strong education, innovation. It becomes more competitive in the global market.

The country develops system to incentivize wealth growth, and build capital markets for lending, bond, insurance, and stocks. The capital market is a great invention, which accelerated Netherland’s rise to the super power. It allows the debtor to borrow the future money with a cost to shorten the saving process; it also helps the creditor to grow wealth with capitals.

With the global trading shares increased, its currencies become more desirable, not only for trading, but also for wealth storehold. It may eventually become reserver currency to further lower the borrowing costs.

Top

In the top phase, the gap between the leader and followers are narrowed because:

- The living standards improve and increased labor cost make the leading country less competitive.

- The followers can copy the leading country’s experience and technology, aka time machine theory in the tech industry.

- The optimism of future wellbeing encourages people to work less and borrow more, which in turn widens the wealth gap between the haves and have-nots.

The reserver currency gives the country “exorbitant privilege” to borrow more money cheaply. Inevitably, the overconsumption and global military maintenance overstretch the empire to be unprofitable.

The Decline

With more debts accumulated due to the reserve currency status, the leader country may have a hard time to borrow more in the economic downturn. Devaluing the currency is a less evil, and less painful approach to monetize the debts compared to the default. The inflation would boost assets price, and further widen the wealth inequity gap.

That leads to political extreme and populism leader to rise. The rich run in fear of anti-capitalism and higher tax burden. Productivity decays, and cause more conflicts on how to slice the shrinking pie. The conflicts has to be resolved peacefully or through violent revolution.

The shrunk economy cannot sustain the global miliary provision, the super power may retreat or might get defeated by the regional power. The reserver currency status weakened, and eventually obsolete, — which ends the Big Cycle.

The Determinants

Many empires followed the Big Cycle, back to Roman empire, to today’s United States. The author proposed 3, 5, 18 determinants which drive the big cycle:

- Good and bad finance

- Internal order and disorder

- External order and disorder

- Education

- Innovation and Technology

- Cost competitiveness

- Military strength

- Trade

- Economics output

- Markets and financial center

- Reserve currency status

- Geology

- Resource allocation efficiency

- Act of nature

- Infrastructure of investment

- Character / Civility

- Governance / Rule of law

- Gaps in wealth

These determinants can be categorized in the following buckets:

| Buckets | Determinants |

|---|---|

| Cycles | 1, 2, 3 |

| Productivity | 4, 5, 6, 13, 15 |

| Finance | 8, 9, 10, 11 |

| Social | 16, 17, 18 |

I think the productivity is the deciding factor here. Even with the elevated labor cost, the productivity continue to grow thanks to the education and technology advancement, and keep the leader a competitive edge. The growth could mitigate the internal conflicts, — just look at contemporary China for example.

Long-term debt cycle

Let’s take a close look at long-term debt cycle:

- Little or no debt with hard money.

- Claims on hard money, such as notes emerge.

- Debt increase with more claim than the hard money.

- Debt crises, defaults, and devaluation with more money printed1.

- Fiat money comes, and leads to debasement of money.

- Then the fight back into hard money.

It is worthy noting that the hard money, which carries intrinsic value, such as gold, is scarce by nature. With prosperity of gross products and services, the limited money supply, aka deflation, would hamper the economic growth. That is why Bitcoin should never work as currency in my opinion.

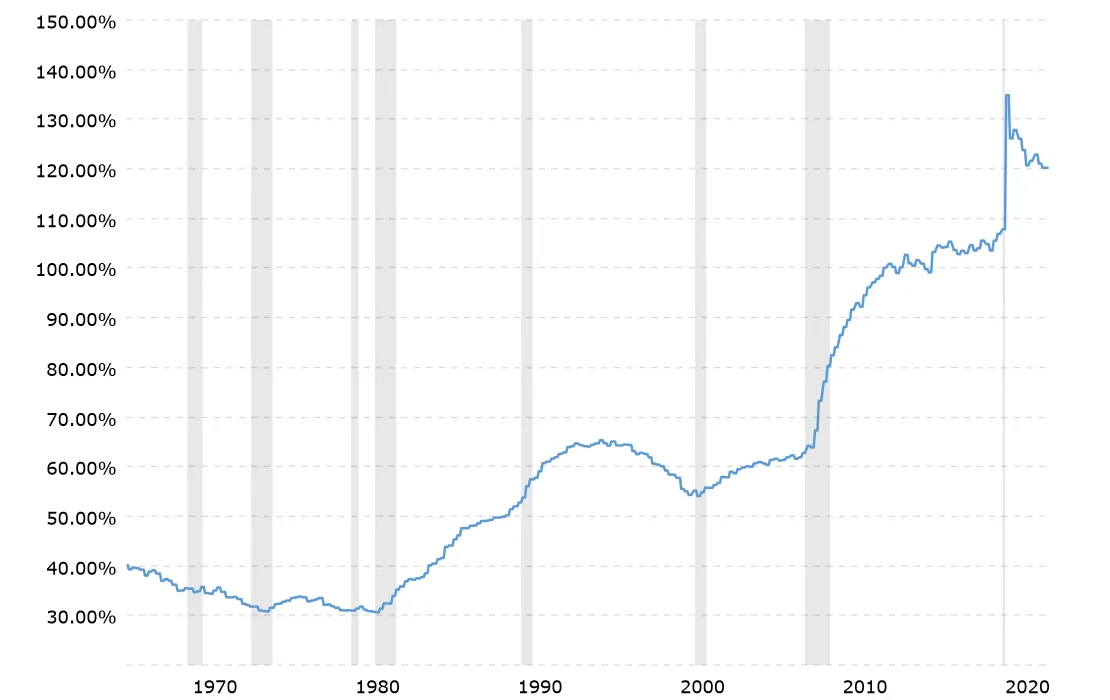

Today, almost ALL circulated currencies are fiat money, and we are in the late stage of long-term debt cycle since Bretton Woods agreement, we should keep a close look at the trend.

Internal order and disorder cycle

The internal order and disorder cycle also has 6 stages, notably, US currently is in Stage 5.

- The new leadership consolidates the power.

- Resource allocation are refined.

- Peace and prosperity.

- Great excesses in spending and debt and widening wealth gap.

- Very bad financial conditions and intense conflict.

- Civil wars / resolutions to clean the house.

External order and disorder

When the old power decays, and new power rises, the skirmishes, conflicts, fights, and even wars seem inevitable, in the following forms:

- Trade / economic wars

- Technology wars

- Capital wars

- Geopolitical wars

- Military wars

Where are current world in the Big Cycle

We are in the late long-term debt cycle designed in 1944 in Bretton Woods after the World War II. United States is in Stage 5 of internal order cycle facing intensified competition from the rising power, China.

The credit / debt cycle

The Federal Reserve steadily increased the interest rate since March 2022 to combat the inflation. This should help the deleveraging.

Rise of China

Will China surpass US to define the new world order proposed President Xi Jinping, community of shared future for mankind(人类命运共同体)? I was not confident as the author because China showed several signs of unsustainable economical growth.

Population decline and Aging

Thanks to 30-year One Child policy, China’s fertility rate decreased from 2.6 in the late 1980s to 1.15 in 2021, and its population reached the peak on 2022, and started to shrink. The estimated 60+ years old constituted 18% on 2019.

The One Child policy worked like the long-term debt cycle: the China government slashed off the investment on the young population to capitalize the demographic dividend(人口红利), and now the debt must be paid back.

Deeply indebted

China has accumulated debts equivalent to 250% GDP, most in the private sector. This is counterintuitive of the saving tradition due to the Chinese real estate market. The housing price skyrocketed in the last 20 years, especially in the major metropolitan areas where medical and eduction resources concentrated. It is a trenched consensus to buy more real estate assets with full leverage as a shortcut for fast wealth growth.

Local government also identified the land usage transfer as a reliable income source after the central government consolidate the tax collection agencies. With the Local Government Financing Vehicles (LGFVs), the total debt of local government has swelled to a record $9.5 trillion.

Inefficient resource allocation

The gui jin min tui(国进民退) economic policy, — the state enterprise advance, the private sector retreat, drives the private enterprise out of critical business. Though the state enterprises are in general less efficient with easy access to capital and monopoly-esque positioning.

The private sectors were also concerned about the uncertainty stemmed from the rapid policy changes for the recent crackdown on Didi, Ant Group, and EdTech industry. The detention of super rich such as Jack Ma, and Bao Fan have a chill effect for the self-made billionaires, — almost all founders of the top-tier internet company in China, except Pony Ma from Tencent, have retired on their 50s, even 40s to escape from the spotlights.

Internal conflicts emerging

The normal Chinese citizens are OK to the government’s tight control of every perspectives of daily life, and simply ignore the politics as there are plenty of opportunities for prosperity. They suffered the pain of human rights being violated in the pandemic. People were detained to the mobile hospitals for COVID tested positive, their homes were sprayed without their consents.

Young generations felt devastated because of the limit class mobility, — thousands of candidates compete for one role in the public sector; others just throw the towel, lay flat, — no marriage, no kids, no real estate.

US-China conflicts intensified

The fights between China and US have been escalating:

- Trump administration launched the trade war on Jan 2018, and the tariff was kept in place in the Biden administration.

- Biden administration sanctioned Chinese corporations, represented by Huawei to access advanced chips. Furthermore, it coordinated with allies to block the EUV sales to slow down the Chinese semiconductor development.

- SEC argued that Chinese corporation listed in US capital market through VIE NOT meet the accounting regulation, which may block their access to US capital market.

- The skirmishes in the Taiwan straight escalated continuously, such as high- profile officials, Nancy Pelosi’s visit.

I agree with the author that Taiwan might be the trigger for US-China war.

The suppression in Hong Kong wore off the creditability of “One country, two system” policy. It is a mirage to unite mainland China and Taiwan peacefully without fundamental political reform in China. China has the will and capability to complete the China unity with arm force. The question is not how to start a war, but how to end it.

- Will US honor the treaty and confront wit PLA? It is a hard choice to US. They don’t want to look weak and further compromise the super power status, and they have slim chance to win in the Asian Pacific region.

- Will allies in both sides join and escalate? In US side, Korea, Japan, Philippian(?), Australia; and in China side, Russia(?), Iran(?). This will determine whether the war will spill over to larger scale.

- Will China survive from US’s sanction? Unlike Russia or Iran, China’s economy is highly dependent on product export. Without the western markets, millions of workers will lose their jobs, — this would be a stress test to China’s social safety net.

Closing thoughts

I finished this book during my cruise trip to Mexico. I enjoyed the Big Cycle analysis with a bird view in the thousand years span. The determinants remind me Jared Diamond’s Collapse and Upheaval, with similar discussions but mostly from the environmental and civil point of views.

It became serious when I looked at where we are. The power is further consolidated around President’s Xi Jinping’s leadership, and this brings lots of uncertainty to the world order. The United State is polarized with widened wealth inequity, — that usually leads to the oppression on the minorities. We should prepare for the worst and hope the best in this changing world.

Footnotes

-

The key is to create enough money and devaluation to offset the deflationary depression without introducing inflationary spirals. ↩